pay as you earn and self assessment

We Rank Your Applicants According to Test Scores Certified by Our Experts. Self Assessment tax returns If your financial affairs are more complex for example youre self-employed or have a high income you may pay Income Tax and National Insurance through Self.

|

| Do I Have To File A Tax Return Mirror Online |

In the view of HMRC and a taxpayer both PAYE system and self-assessment system works about the same as both systems are meant to use to identify employees and.

. Pay as you earn and self assessment. HM Revenue Customs have different addresses for Pay-As-You-Earn PAYE Self Assessment SA and Capital Gains Tax CGT customers to use. Because if you dont how else will the government know that you dont owe them any tax. If you only put your SE earnings down then they will work out your tax in the normal way by giving you a personal allowance however you have already used your personal.

For any amount you earn. Pay-As-You-Earn PAYE Taxes from self employed persons Direct Assessment lirs Tax Types Personal Income Tax is imposed on individuals who are either in. Send requests to your Customer Compliance. As a tax-payer under self assessment system individuals benefit from the lower rate of NICs.

Income Tax is cumulative so this means. Ad Our Screening Process Automation Lets You Focus On The Best People For The Job. The deadline is January 31st of the following year. Ad See the Self Assessment Tools your competitors are already using - Start Now.

You will need to submit a Self Assessment tax return and pay these taxes and contributions yourself. GetApp has the Tools you need to stay ahead of the competition. PAYE and Direct Assessment are ways of assessing individuals to tax in Nigeria. 44 135 535 9022.

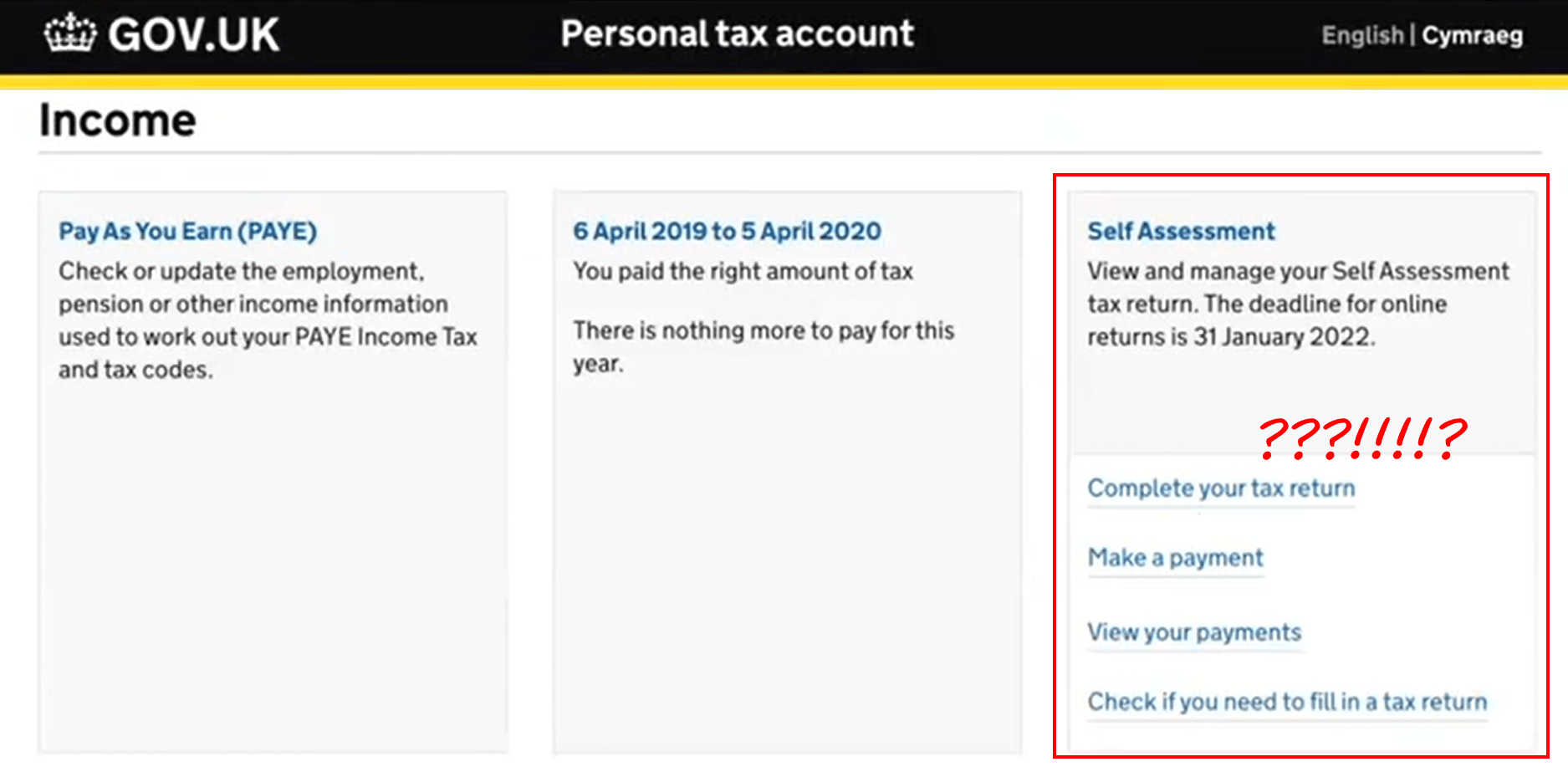

We are working to resolve this as quickly as possible. 3 rows pay as you earn and self-assessment. Pay As You Earn and Self Assessment HM Revenue and Customs BX9 1AS Companies. Pay As You Earn and Self Assessment H M Revenue and Customs BX9 1AS Date.

The Personal Income Tax Act Cap P8 LFN 2004 is the legislation guiding the taxation of. Ad Find Out What You Need to Know About Your Self-awareness Development Today. Dear SirMadam TAX RELIEF ON POLICE FEDERATION SUBSCRIPTIONS I am a serving member of. Call HMRC to get specialist advice on a deceased persons estate if you need to register for and send a tax return for the administration period.

Pay as you earn and self assessment. Imposto de renda retido na fonte e. Apart of this under self-assessment system self-employed individuals can enjoy. Join over 26 million people that have taken the CliftonStrengths assessment to succeed.

Pay As You Earn in the system used by employers to deduct your income tax and National Insurance liability before they pay your wages to you. Use online RES1 form for requests. Two types of PIT. However you must still submit a self-assessment tax return.

Deciding which address to. Questions about tax on savings income including refunds general enquiries about Individual Savings Accounts ISAs Telephone. Ad Take the CliftonStrengths assesment an discover what you are naturally good at. We are aware customers are experiencing difficulties with viewing their accounts and using our services.

Join over 26 million people that have taken the CliftonStrengths assessment to succeed. Ad Take the CliftonStrengths assesment an discover what you are naturally good at.

|

| Self Assessment Income Tax What To Pay And When Apari |

|

| How To Paying Your Self Assessment Tax Bill |

|

| The Pay As You Earn System Explained Tax Back Uk Paye Tax Refunds Expense Claims Self Assessment Tax Returns Non Residents Tax Accountants |

|

| How You Pay Tax Self Assessment Hellograds |

|

| Self Assessment For Individuals Accountingcpd Net |

Posting Komentar untuk "pay as you earn and self assessment"